Privacy; Is It a Right or a Privilege – Privacy in the Insurance Sector

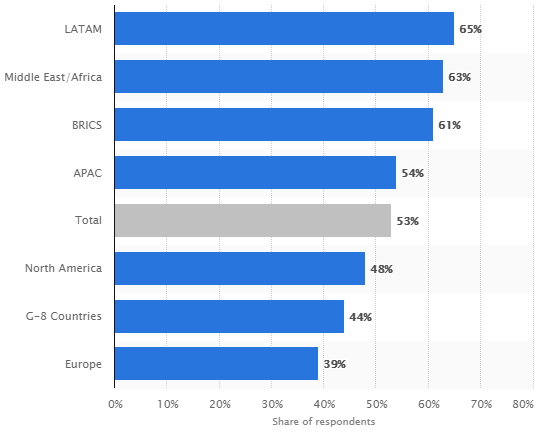

A survey published in 2019 showed that globally, 54% of individuals were concerned about their privacy. 68% of Latin Americans and 48% in North America reflected the same concern. More than 61% of Americans suggested that they wanted to do more to protect their privacy. Here is a graph to illustrate our point:

In this digital age, we buy everything online, entertain ourselves online, communicate and socialize via the internet, and post our whole lives online; yet there are things that we would rather keep private. Yet, the platform (internet) enables collectors to see who we are, who we visit, what we do, and even how we think!

This gives rise to a dire question:

What happened to privacy? Is privacy a right or a privilege?

The reason why, in the graph above, Europeans are least concerned about their privacy is the sheer number of strict privacy laws in the continent. Ensuring your own and your family’s security is easy there. From PII (personally identifiable information) to medical records, all of it is kept secure because in Europe, privacy is a right.

The California Consumer Privacy Act (CCPA)

In the US, the state of California passed a digital privacy protection law; the CCPA. It came into effect in January 2020 and imposes fines on businesses that collect information but can’t protect it. This act is headed in the direction customers want; i.e., making privacy a right, not just a privilege.

How does it become a right?

First and foremost, the CCPA asks businesses to keep a record of how the information is used and to whom it has been disclosed. Customers now have the option of requesting information about how, when, what, and to whom the information gathered has been disclosed.

This means CCPA doesn’t allow companies to sell personal information about consumers. Furthermore, the law protects companies who deny the sale of information to third parties against retaliation.

Privacy as a Right in Terms of Insurance

Just like attorney-client privilege is applicable in law; it is also applicable in the insurance sector to ensure clients safeguard their privacy and in turn protect their families. However, the insurer-insured privilege is slightly more complex compared to litigation scenarios.

This is a privilege that allows clients to be as thorough with their attorney or insurance agents as possible. The law prevents third parties from extorting said information from attorneys or agents thenceforth.

The goal of this privilege is to ensure that agents and attorneys can give sound advice to their clients and serve them to the best of their abilities. This law-awarded sense of privacy is a privilege because it is an entitlement awarded by the State or Country.

Since in the insurance sector, sharing of information is necessary to determine the actual loss value and intentions of the client, the privilege may be waived for certain third parties. However, the shared information will always be limited to the proper function of the company and the determination of true value.

Information irrelevant to the case is covered by your privacy right, i.e., an irrevocable entitlement held by all since birth.

As far as privacy with regard to your legacy and financial portfolio is concerned (especially one that you intend to keep to protect your family), IronClad Family can help you store all your information safely in one of our private vaults.

To learn more, get in touch with us today!

Michael Lester

I spent years flying Marine Corps combat missions believing I understood America’s role in the world. Today I work in national security and cybersecurity, helping organizations understand risk, resilience, and the systems we rely on. My writing continues the same mission—bringing clarity to complex issues and inviting people to look past slogans so we can understand who we are, what we do in the world, and why it matters.