In today’s digital world, traditional methods of storing critical documents like wills are quickly becoming outdated. As families face increasing concerns over accessibility, security, and privacy, many turn to encrypted digital vaults for secure, organized, and reliable document storage for end-of-life planning.

If you're wondering, "Where can I store a will securely online?" this guide will provide clear answers, practical steps, and insights into why a digital vault is the best choice for safeguarding your legacy.

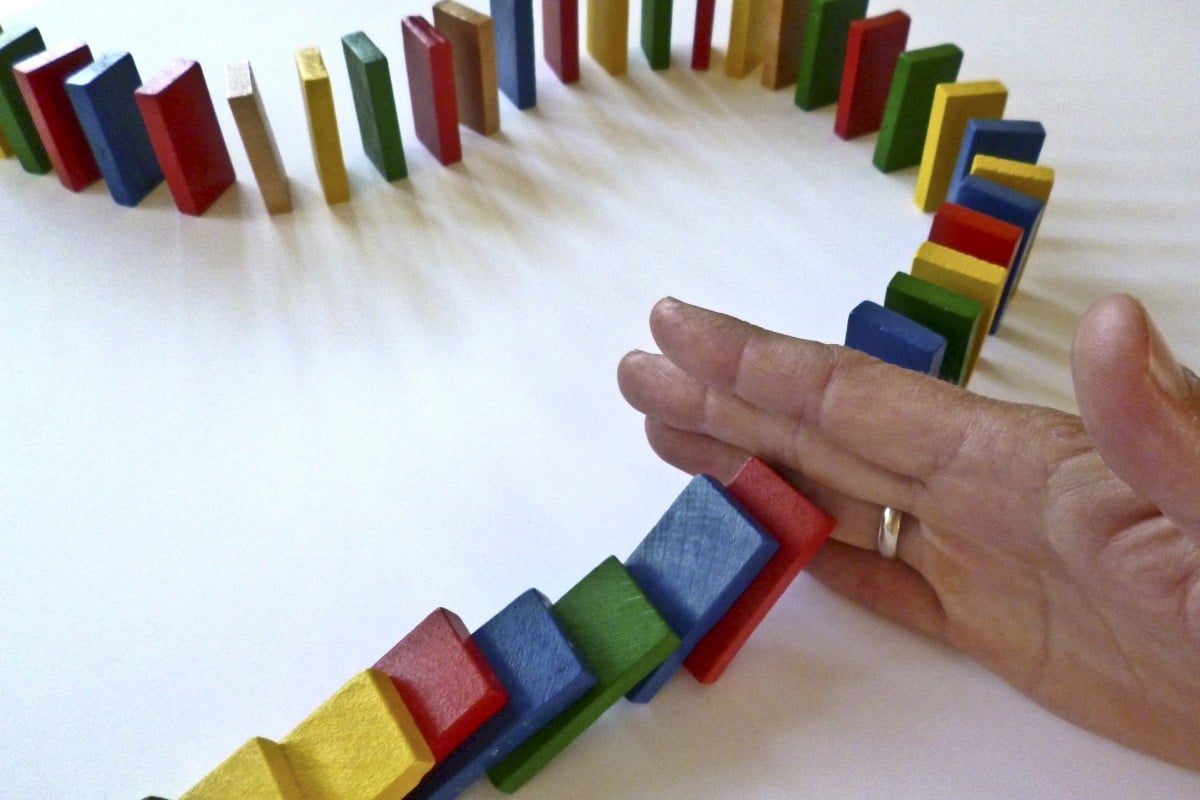

Why Traditional Will Storage Methods Are Risky

Historically, people have relied on physical storage options for wills, such as safes, filing cabinets, or safety deposit boxes. However, these methods come with significant risks:

1. Vulnerability to Damage or Loss

Natural disasters, fires, or water damage can destroy physical documents. According to FEMA, 25% of businesses affected by disasters fail to reopen, partly due to lost records. Families face similar risks when storing wills in physical locations.

2. Limited Accessibility

Safety deposit boxes, for instance, can be difficult to access in emergencies. Loved ones may not even know the location of the will, leading to delays and stress during critical times.

3. Risk of Theft or Misplacement

Physical copies are susceptible to theft or being misplaced. Without a backup, the consequences can be irreversible, leaving families unprepared.

The Benefits of Encrypted Digital Vaults for Estate Planning

Digital vaults are revolutionizing how individuals store and manage their wills and other essential documents. By providing encrypted digital vaults, platforms like IronClad Family ensure a level of security and convenience that traditional methods simply cannot match.

1. Advanced Security with Encryption

Digital vaults use cutting-edge encryption, such as zero-knowledge encryption, which means your data is encrypted on your device before it reaches the cloud. This guarantees that even the service provider cannot access your files.

2. Easy Accessibility Anytime, Anywhere

Digital vaults eliminate the barriers of physical storage by making documents accessible via any device. Whether you’re at home or traveling, your will is just a click away.

3. Automated Emergency Access

Platforms like IronClad Family allow you to set up automated delivery systems, ensuring your will is delivered to the right people when it's needed most.

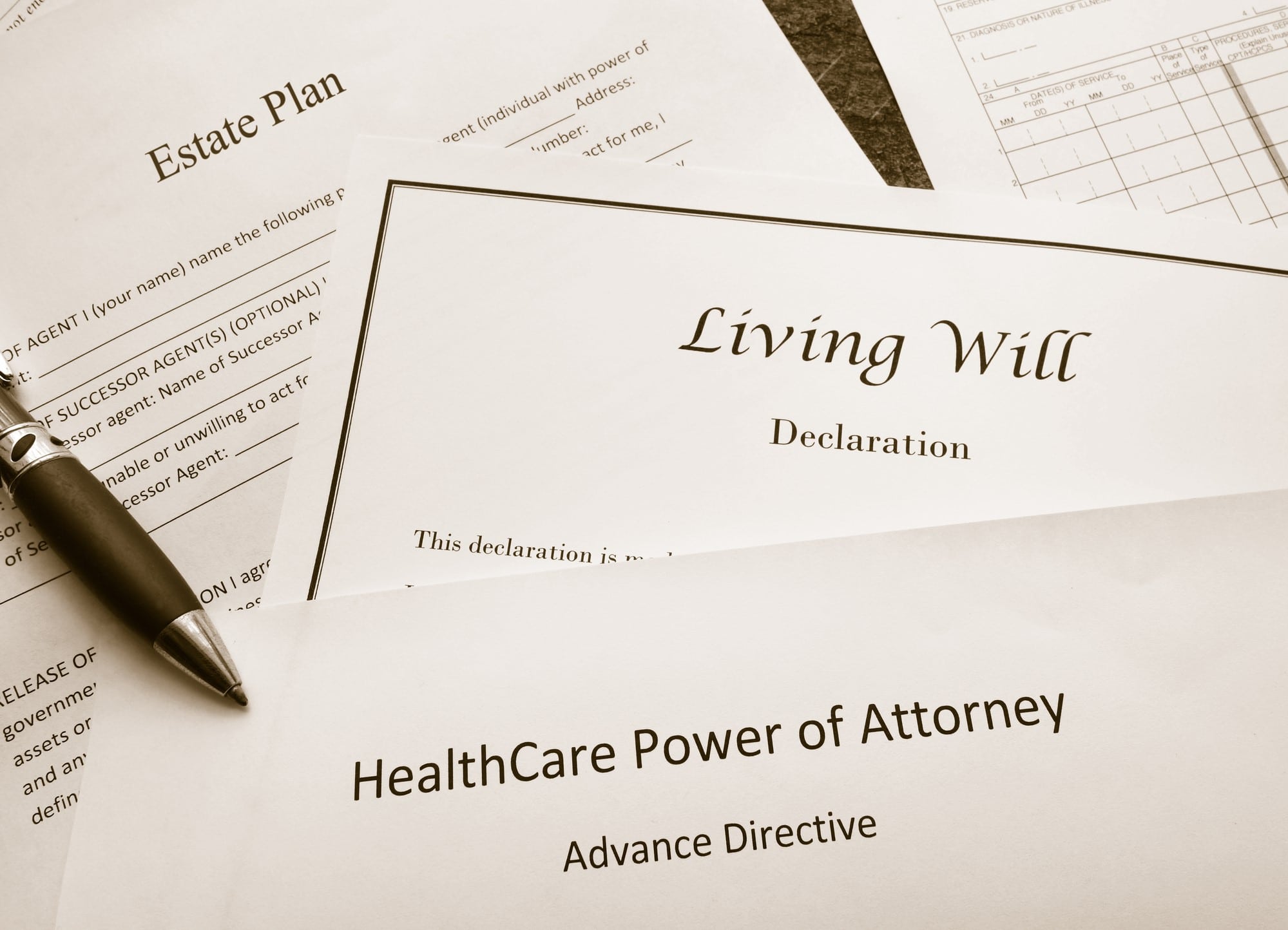

4. Centralized Document Management

A digital vault provides a single, organized space for all end-of-life planning documents, including wills, medical directives, and insurance policies. This streamlines access and eliminates confusion for your loved ones.

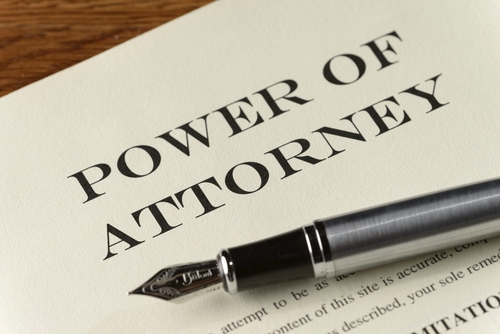

Step-by-Step: Where to Store a Will Securely Online

If you’re ready to transition your will to an encrypted digital vault, follow these steps:

Step 1: Choose a Reliable Digital Vault Provider

Look for a platform that prioritizes security, accessibility, and family-centric features. IronClad Family’s Digital Vault is a top choice, offering robust encryption, user-friendly interfaces, and emergency access tools.

Step 2: Digitize Your Will

Scan your physical will into a high-quality digital format (PDF recommended). Ensure the file is legible and stored in its entirety.

Step 3: Upload Your Will to the Digital Vault

Log into your digital vault and upload the file. Use clear labeling, such as “Last Will and Testament,” for easy identification.

Step 4: Organize and Categorize Documents

Store your will in a dedicated folder for legal documents. Consider creating additional categories for financial records, medical directives, and personal letters.

Step 5: Assign Access Permissions

Designate trusted individuals—such as family members or legal representatives—who will have access to your will. Set specific permissions to control what they can view and when.

Step 6: Test Your Vault

Ensure that all uploaded documents are accessible, and permissions work as intended. Conduct periodic reviews to keep your vault up to date.

Automating Emergency Access to Vital Documents

One of the standout features of a digital vault is its ability to automate the delivery of critical documents during emergencies.

How It Works

- Set specific triggers, such as health emergencies or passing, that activate document delivery.

- Pre-assign recipients, ensuring that your will reaches the intended party without delays.

Why It Matters

During emotionally charged times, automated delivery removes the burden of locating and sharing documents, allowing families to focus on what truly matters. Platforms like IronClad Family excel in providing these capabilities, offering both efficiency and peace of mind.

A Real-Life Scenario

Imagine a scenario where a family is unaware of the location of their loved one’s will. With an automated digital vault, the document is securely delivered to their inbox, ensuring the family can act promptly and in accordance with the individual’s wishes.

The Rising Trend of Digital Vaults

The shift toward digital vaults reflects broader trends in personal and family data management:

- Increased Adoption: A report by MarketWatch predicts significant growth in the digital vault market, driven by rising concerns over data security and accessibility.

- Estate Planning Modernization: According to a 2023 AARP study, 60% of individuals prefer digital solutions for estate planning due to their convenience and security.

Try IronClad Family’s Digital Vault Today

Storing your will securely online is not just about convenience—it’s about protecting your legacy and ensuring your family’s peace of mind. With IronClad Family’s Digital Vault, you can:

- Safeguard your will and other critical documents with advanced encryption.

- Set up automated delivery for seamless emergency access.

- Enjoy centralized, organized document storage tailored to your family’s needs.

Don’t wait to secure your legacy. Start your 14-day free trial today by visiting IronClad Family’s Digital Vault. Experience the future of estate planning with the confidence that your family will always be prepared.

.png)

.png)

.png)

.png)

.jpg)

%20(3).png)

.png)